geothermal tax credit form

You may not claim this credit after Tax Year 2021. Start completing the fillable fields and carefully type in required information.

26 Solar Federal Tax Credit Own It Solar

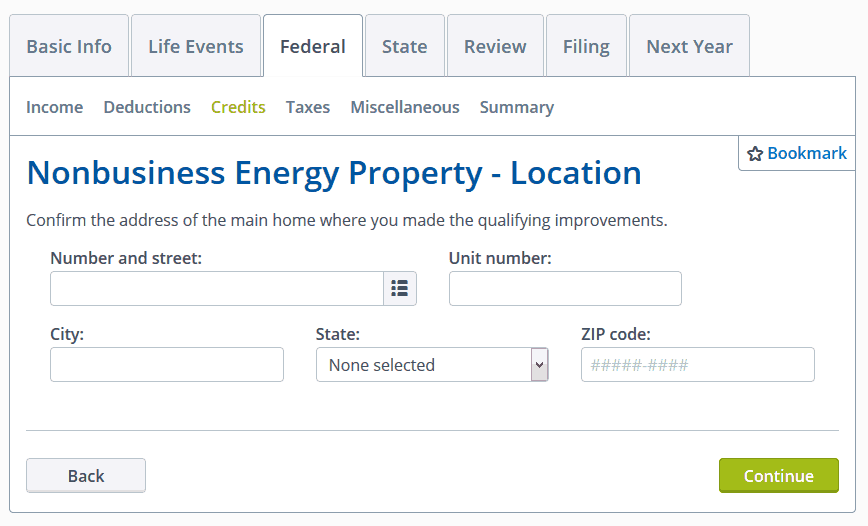

Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit.

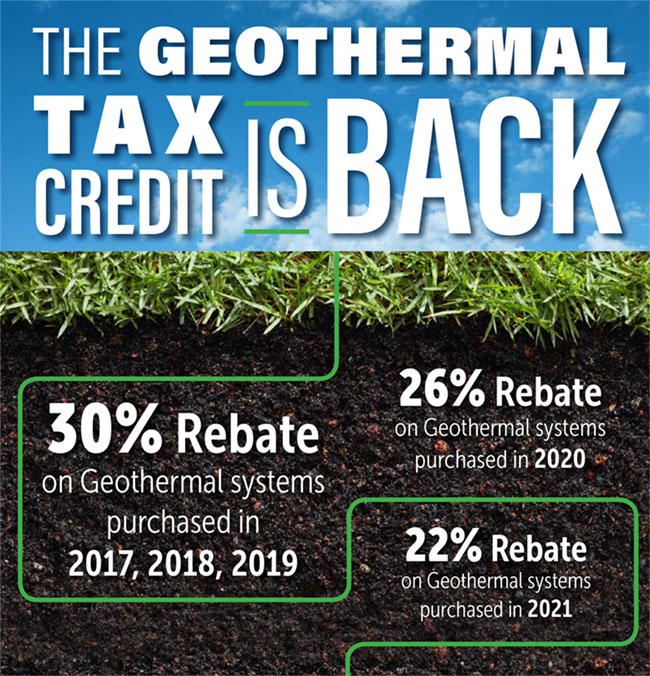

. How to Claim the Credit. The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMTIf the federal tax credit exceeds tax liability the excess amount may be carried forward into future years. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009.

A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. Tax Credit Amount. Use Get Form or simply click on the template preview to open it in the editor.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Geothermal heating and cooling takes advantage of the natural stable warmth stored in the earth. Water heaters account for 12 of the energy consumed in your home.

Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies. Check Out The Residential Tax Incentive Guide. Ad 26 Federal Tax Credit.

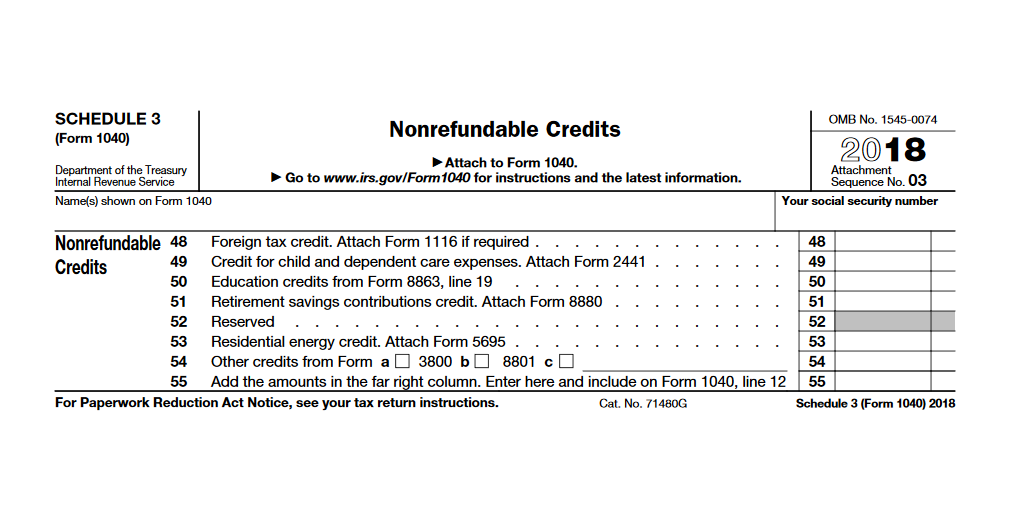

2017 IA 140 Iowa Geothermal Tax Credit Instructions The Iowa Geothermal Tax Credit equals 10 of taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers residence or as a thermal energy sink to cool the residence. The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT. Attach to Form 1040.

Geothermal For 0 Down. You may still carry forward any remaining tax credit until the carryforward period expires. Residential Energy-Efficient Property Credit.

Enter the total of the following credits if you are taking the credits on your 2020 income tax return. For property placed in service after 2009 theres no limit on the credit amount. Geothermal Company in CanadaBritish ColumbiaAbbotsford 30226 Townshipline Rd In addition to the federal tax credit some state local and utility incentives may be.

This credit was repealed by the 2021 Montana State Legislature. Geothermal System Credit Form ENRG-A December 30 2021. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water.

Electric Heat Pump Water Heater. Sign-Up For A Free Consultation. Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information.

Upgrade To Geothermal For 0 Down. Normally the earth temperature is around 55 degrees F 13 degrees C at depths of 10 ft. This tax credit allows you to deduct 26 percent of the cost of installation from your federal taxes.

RenewGeo is the innovative technology of collecting solar energy in the form of heat and injecting this heat into the ground to create a synthetic geothermal resource. Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit. In climates warmer than 55 this can be used to air condition a building and in colder climates those under 55 it can be used for heating.

For property placed in service after 2009 theres no limit on the credit amount. Ultimately the tax credit was reinstated in early February 2018. Foreign Tax Credit Schedule 3 Form 1040 Part I line 1 _____ Credit for Child and Dependent Care Expenses Schedule 3 Form 1040 Part I line 2 _____.

Ad Look For Geothermal Tax Credits Now. The heat is stored daily to create a thermal battery that can be tapped and transformed into. The tax credit equaled 10 of the taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers dwelling or as a thermal energy sink to cool the dwelling.

The Federal Investment Tax Credit applies to both solar and geothermal. The tax credit is 26 for systems placed in service by 12312022. Find Everything about Geothermal tax credits and Start Saving Now.

This Tax credit was available through the end of 2016. Enter the amount from Form 1040 1040-SR or 1040-NR line 18. For systems placed in service by 12312023 the tax credit is 22.

The equipment must meet the federal energy star. Most ENERGY STAR certified water heaters meet the requirements of this tax credit. You may use this form to claim your geothermal system credit.

The incentive will be lowered to 22 for systems that are installed in 2023 so act quickly to save the most on your installation. Quick steps to complete and e-sign Fillable Online Understand The Geothermal Tax Credit online. 300 Requirements Uniform Energy Factor UEF 082 OR a thermal efficiency of at least 90.

Our Energy Star rated geothermal systems will qualify for the federal personal income tax credit in the amount of 30 of the total installation cost. From 2017 to January of 2018 there was an ongoing fight to extended this tax credit. Save 1000s on a New Geo System.

Taxpayers filing a claim for the Geothermal Tax Credit were required to submit Form IA 140 in addition to the IA 148 with the individual income tax return.

Geothermal Tax Credit Explanation

Types Of Renewable Efficiency Tax Credits With Links Attainable Home

How You Can Get Energy Efficiency Rebates And Tax Credits Energy Efficiency Solar Energy Diy Solar Energy Companies

Heated Up Guidance On The 26 Tax Credit For High Efficiency Wood Heaters

The Energy Tax Aspects Of Geothermal Heat Pumps Energy Tax Savers

Instructions For Filling Out Irs Form 5695 Everlight Solar

Energy Efficient Home Improvement Tax Credits Taxact Blog

Geothermal Tax Credit Explanation

2009 Home Improvement Tax Credit Forms

Residential Energy Credit Axion Building Products

Irs Schedule 3 Find 5 Big Tax Breaks Here

Geothermal Tax Credits Explained

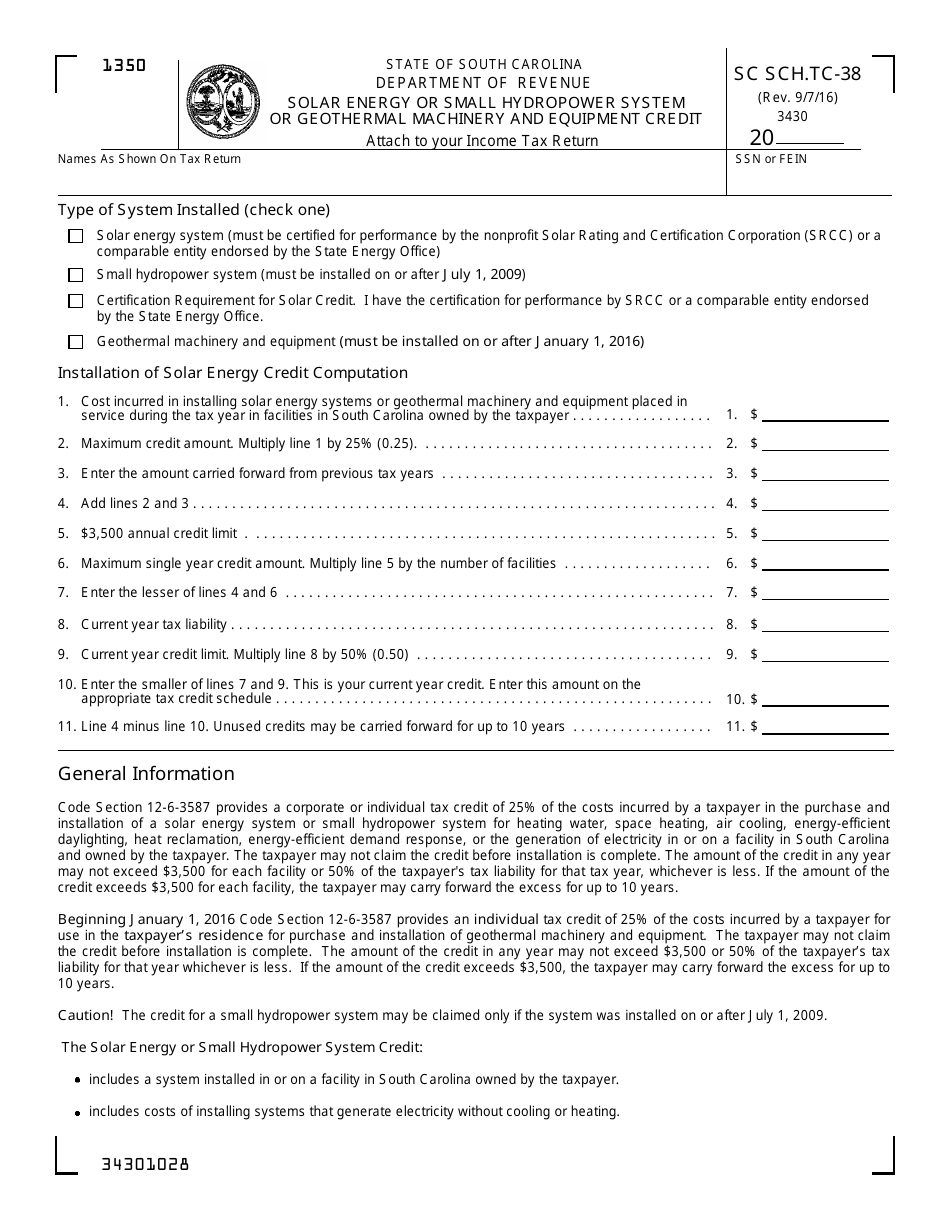

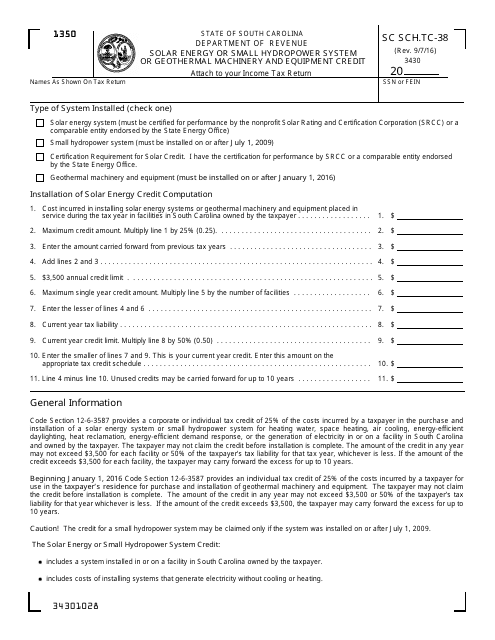

Form Sc Sch Tc 38 Schedule Tc 38 Download Printable Pdf Or Fill Online Solar Energy Or Small Hydropower System Or Geothermal Machinery And Equipment Credit South Carolina Templateroller

Form Sc Sch Tc 38 Schedule Tc 38 Download Printable Pdf Or Fill Online Solar Energy Or Small Hydropower System Or Geothermal Machinery And Equipment Credit South Carolina Templateroller

The Federal Geothermal Tax Credit Your Questions Answered

Geothermal Tax Credit Reinstated Corken Steel Products